The industry hurting from discontinued bakkies in South Africa

The aftermarket accessory industry has been hurt by the shrinking bakkie market in South Africa, in particular the canopy industry.

Speaking to Dealerfloor, Derek Caldicott, Managing Director of Andy Cab Canopies, said that the demise of high-volume bakkies like the Ford Bantam, Opel Corsa/Chev Utility, and, more recently, the Nissan NP200 has wreaked havoc on the canopy sector.

“The market size for canopies remains unchanged; the challenge lies in distributing the same share among the competitors in the industry,” said Caldicott.

“People might think that with the increased number of bigger bakkies we all see around us, it means the canopy business is a booming one. It is not.”

Caldicott explains that the current bakkie market is relatively resilient in terms of sales and the number of available models; this means that for one canopy maker to experience growth, it must usurp market share from another.

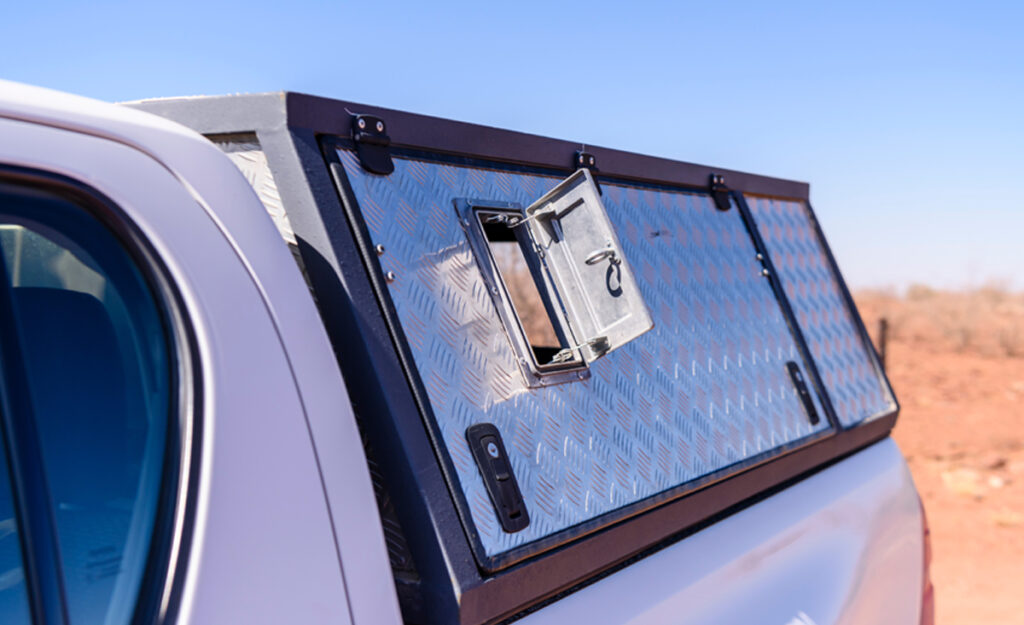

“The arrival of metal canopies has had an impact on our market share,” he said, noting that Andy Cab remains focused on fibre glass products.

A new point of contact

The industry veteran further revealed that the canopy business has changed from primarily being cash-based to one where the accessory is financed along with the vehicle and purchased as an optional extra directly through the car company.

They are then fitted at independent centres across the country that have agreements with various accessory suppliers.

“Today we rely on independent fitment centres with which we have agreements, and our products also feature on most Original Equipment Manufacturers’ inventories as options for bakkies,” said Caldicott.

“We do have our own fitment centre in the Cape at our factory and a distribution hub in Gauteng. Logistics plays a significant part in our operations, getting the supply to fitment centres throughout the country.”

The fundamental shift in the canopy industry has made it much tougher for new entrants and smaller players to remain competitive as the cost associated with setting up and maintaining a production facility as well as a distribution network is tremendous.

“Each bakkie brand, and the different body styles like single, double, or extended cab, has its own mould, and the tooling is expensive,” said Caldicott.

“Before deciding to produce a mould one needs to determine if the demand for that specific bakkie will justify the investment of a mould. With a number of new players, especially from China entering the local bakkie market, the investment requirements on canopy manufacturers are onerous.”

He added that consumers mustn’t be fooled by these fly-by-night newcomers, and should opt for reputable brands that have a proven track record for quality and after-sales support should they be in the market for a canopy or other accessories.

“With canopies ranging from R15,000 to R50,000, getting the right product from an established brand with the necessary back-up service is crucial, and in the end, it is the little things that can make a big difference to the customer experience,” concluded Caldicott.