This group of people in South Africa won’t pay higher petrol taxes

The South African National Taxi Council (Santaco) said that its members won’t raise prices after the new fuel taxes take effect in June.

Minister of Finance Enoch Godongwana this week proposed that the General Fuel Levy (GFL) be expanded for the first time in three years, ending a relief measure that was first introduced during the Covid-19 pandemic.

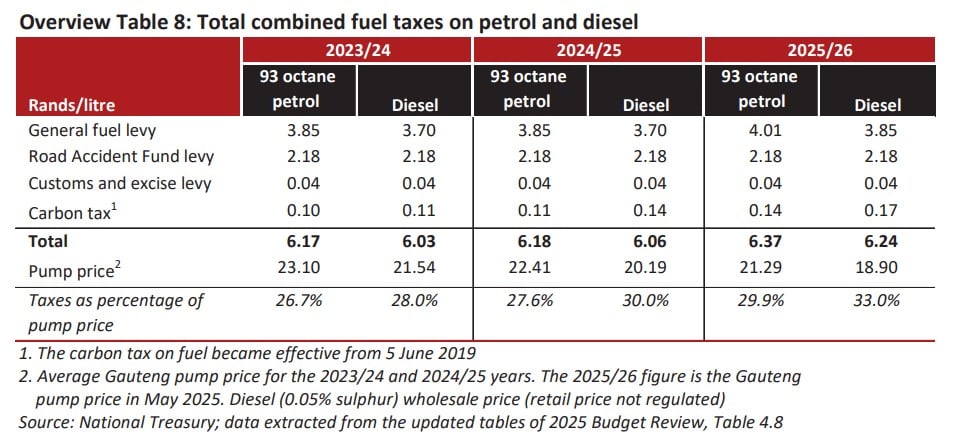

Owing to the planned VAT hike no longer being on the table, Godongwana proposed an increase in the GFL to the tune of 16c per litre for petrol and 15c per litre for diesel.

These are in addition to a 3c per litre Carbon Levy increase that already took effect in April.

The Carbon Levy is an add-on to the GFL, meaning the latter is effectively rising by 19c and 18c per litre for petrol and diesel, respectively, in the coming financial year.

As a result, from 4 June onwards, the GFL will be pegged at R4.01 per litre for petrol and R3.85 per litre for diesel.

The higher GFL is key in government’s efforts to make up an enormous budgetary shortfall.

Other measures include spending cuts of R69.4 billion over three years in education, health, home affairs, and Transnet.

The table below, as provided by Treasury, details the total combined taxes on petrol and diesel for the coming financial year:

A bleak outlook

Mandla Hermanus, spokesperson for Santaco Western Cape, said the higher GFL will hurt the association’s members as it will elevate operating costs.

However, Santaco is confident that taxi operators will absorb the cost rather than passing them on to their riders.

“As much as this increase is going to hit us, we are not anticipating that there will be price increases as a result of the adjustment in the fuel price,” Hermanus told Newzroom Afrika.

“Ordinarily, we do not relook our prices every time there’s a fuel adjustment. Most of the time, we adjust our prices on an annual basis.”

He added that while there won’t be an immediate impact on fares, the higher GFL is likely to affect prices down the line.

Santaco reviews input costs once a year and then decides whether it must keep or hike its rates.

“After June, if there are any further increases in the price that might be due to the rand/dollar exchange and the cost of diesel overseas, that will have an impact,” said Hermanus.

“For now, we don’t foresee that we will adjust our prices, but we will make that determination around October/November, depending on whether there have been any further increases in the fuel price.”

Hermanus indicated that the higher taxes could have a detrimental effect on the industry.

Taxis are limited in how much they can raise their fares to remain competitive versus other forms of public transport that are subsidised by government, such as trains and buses.

Some taxi operators are thus forced to subsidise their passengers just to stay in business.

“The effect is that it reduces how much the drivers are able to earn, and how much the operators are able to make, and it affects the affordability of the vehicles,” said Hermanus.

“So we end up with less cash and sometimes operators end up losing their vehicles because they are no longer able to afford the monthly instalment.”

Private motorists will be less fortunate when it comes to paying fuel taxes from June onwards.

The Automobile Association notes that while it understands the need for the increase, it will certainly come with consequences.

“This levy adjustment comes at a time when South Africans are already contending with high food prices, elevated interest rates, increased electricity tariffs, and persistently high unemployment,” it said.

“Fuel is a critical input cost across all sectors of the economy; any increase inevitably drives up transport and operational costs, further intensifying inflation.”

It said lower-income households, which spend a greater share of their income on transport, will be the most affected.

Meanwhile, the Road Freight Association (RFA) contends that the move will do more harm than good for South Africa over the long run.

It said that the bloated taxes will make freight and transport costs even higher, noting that 85% of goods in the economy is carried by road freight.

Consumers will have to bear the brunt of this additional cost as transporters in the country are already stretched very thin.

“Transport will become more expensive, consumers will pay more, and the old adage that government can keep increasing taxes and levies to fund its uncontrolled spending remains true,” said the RFA.