The one good thing about South Africa’s 19c-per-litre petrol tax increase

The one positive thing about the fuel tax increase announced this week is that it will have a lesser effect on lower-income households than an expansion to Value-Added Tax (VAT).

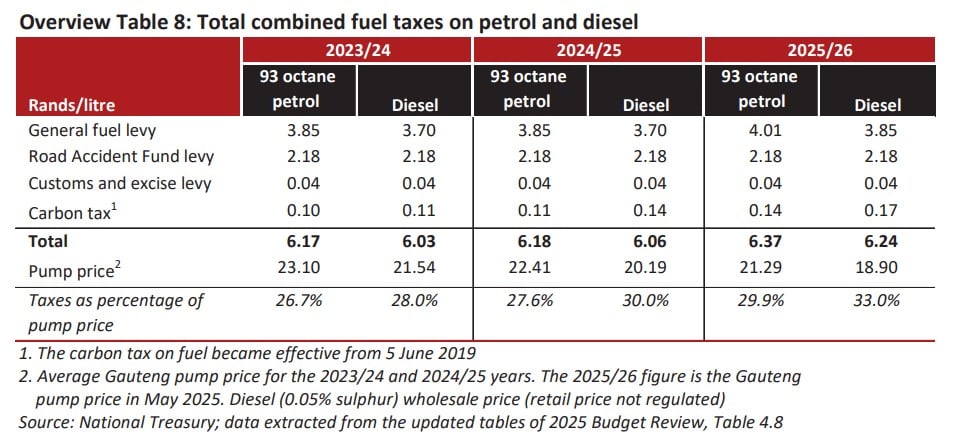

Finance Minister Enoch Godongwana proposed a 16c per litre increase to the General Fuel Levy (GFL) on 21 May 2025 after scrapping the controversial VAT hike that was supposed to take effect earlier in the month.

The expansion of the GFL is on top of a 3c per litre Carbon Levy increase that already came into play in April.

The Carbon Levy is an add-on to the GFL, therefore, motorists will be paying 19c per litre more in petrol taxes from June than they did in March before the tabling of the first Budget.

From 4 June onwards, the GFL will be pegged at R4.01 per litre for petrol, representing 30% of the prices we see at the pumps.

On the bright side, Godongwana announced no changes to the Road Accident Fund (RAF) Levy, the second-biggest tax on local fuels, despite the entity calling for such.

The increase to the GFL was the only tax adjustment Godongwana tabled for the 2025/26 period as government looks to make up a massive budget deficit.

It is the first time in three years that any changes have been made to the GFL, ending a relief measure that was first introduced during the Covid-19 pandemic.

The Organisation Undoing Tax Abuse (Outa) suggested that it was all but guaranteed that fuel taxes were next in line after the VAT hike was canned.

“Given that the fuel levies have not been subjected to an increase for the past three years and the price of petrol has dropped by 12% since May 2024, Treasury’s increase in the GFL by 16c per litre (less than 1% on the total fuel price) was expected,” said Outa.

“This hike, combined with increases to excise duties on alcohol and tobacco by between 6.5% and 9%, reflect government’s increasing reliance on already overburdened taxpayers to close revenue gaps.”

Likewise, the Automobile Association (AA) slammed the increase, stating that continuously turning to fuel levies to fill budget gaps is unsustainable.

“Although the latest increase may appear modest in isolation, it forms part of a broader trend where motorists and transport-reliant industries bear the brunt of fiscal policy changes,” said the AA.

“South Africa must have a broader conversation about funding infrastructure, road safety, and public transport in a way that doesn’t unduly burden citizens.”

The AA once again called for a comprehensive and transparent review of South Africa’s fuel pricing model.

This should include:

- Exploration of alternative funding mechanisms that reduce reliance on fuel-based taxation

- A forensic audit of revenue generated from the GFL and RAF Levy, including its allocation and expenditure

- Engagement with civil society, labour, and the transport sector to identify fair and sustainable revenue models

- Full transparency on the fuel price-setting formula published by the Department of Mineral Resources and Energy

The table below, as provided by Treasury, details the total combined taxes on petrol and diesel for the coming financial year:

The silver lining

Political analyst Hlumelo Xaba contends that the GFL increase was the lesser of all evils for South Africa.

“The main thing treasury wanted to do was see where they could solicit more funds, or what they can do in terms of generating more revenue, which I think is what led to the increase of the fuel levy,” Xaba told 702.

“I think this is one [adjustment] that is better in terms of revenue generation as compared to the previous one which was really going to affect the working class.”

A increase to VAT will disproportionately impact people who are already struggling to afford necessities as everything in the country will immediately get more expensive.

Granted, transport costs will now rise with the higher GFL and this will have a knock-on effect on the prices of goods we see on the shelves.

As much as 80% of goods in South Africa are delivered via road freight, with higher fuel prices having an impact on the final cost of these items.

However, Xaba pointed out that fuel prices fluctuate based on international prices of oil and the rand/US dollar exchange rate.

Any improvements in these elements could therefore mitigate the impact of the higher GFL.

Sustained improvements may potentially even have a deflationary effect on the cost of goods and services in the country.

In comparison, an increase in VAT will lead to permanent price increases across the board that are unlikely to be undone by positive economic indicators.