What to expect from petrol prices in South Africa in August

Petrol prices in South Africa are expected to go in different directions this August, with 93 looking to go down and 95 looking to go up, both by around 4 cents a litre.

Diesel prices, on the other hand, are all anticipated to rise by roughly 47 cents per litre, marking the second consecutive month in which this fuel type is seeing a much more substantial increase in cost than its more refined counterpart.

This is according to mid-month fuel price data released by the Central Energy Fund (CEF), which takes into account movements in international petroleum product costs as well as the rand/US dollar exchange rate.

According to the CEF, fuel prices in South Africa on the first Wednesday of August are expected to be adjusted as follows:

- Petrol 93 – Decrease of 4 cents a litre

- Petrol 95 – Increase of 4 cents a litre

- Diesel 0.05% – Increase of 47 cents a litre

- Diesel 0.005% – Increase of 47 cents a litre

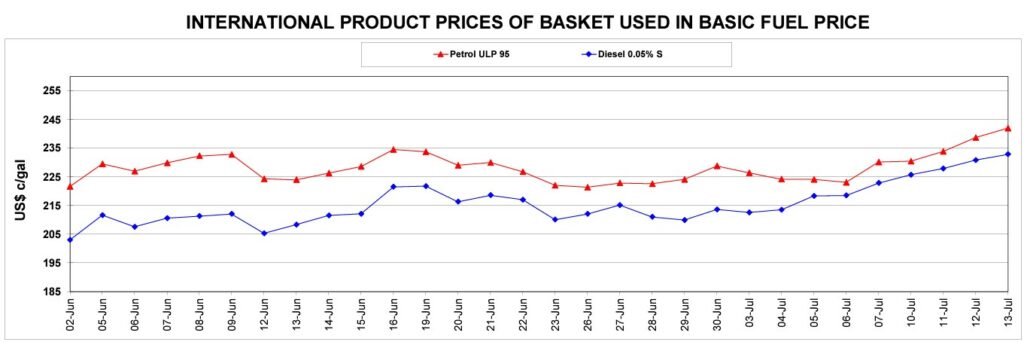

These anticipated changes are largely a result of rising international product prices for both grades of fuel, which are dependent on oil prices.

Oil prices during the month of July rose from approximately $74/barrel to $80/barrel, as a result dragging international product prices for both petrol and diesel along with it.

However, the CEF notes that these are not the official adjustments that will take effect next month, rather, they provide a snapshot of what to expect based on changes in the market from July up until the middle of August.

The official adjustments will be gazetted by the Department of Energy at month-end and will also consider any potential changes in taxes, levies, and margins.

What’s happening with Diesel?

In July, petrol prices went down by a maximum of 24 cents per litre, while at the same time, diesel prices rose by up to 18 cents per litre.

If the current status quo is kept, this trend is looking to continue in August with diesel prices seeing a much less favourable adjustment than petrol.

The anticipated rise in the price of diesel comes off the back of increasing demand for this particular fuel type, as it’s the main propellant used in commercial and domestic applications around the world.

With worries of recessions dying down in most countries, economic activity is picking up once more which, coupled with limited supply coming from Russia and the USA, is putting strain on global diesel reserves and pushing up prices.

According to Shore Capital analyst Craig Howie, “There’s been an increase in trucking activities, stretching demand; concerns over exports to Europe from Russia; shutdowns in the US; and lower refinery runs in China,” reported The Guardian.

“From an oil perspective, China has been a concern. Tough restrictions on movement have hit demand, but lockdowns have also reduced some refining capacity, too.”

In addition, the Russia-Ukraine war has seen Russian-made diesel all but disappear from the market in many Western economies, subsequently pushing demand onto smaller diesel refineries in other countries that don’t normally have to produce as much.

Fuel reserves around the world are now also much lower than they were before the Covid-19 pandemic and European conflict, meaning governments have fewer resources to cushion the impacts of unpredictable market fluctuations.

“The US Energy Information Administration estimates that stocks of US distillates – typically diesel and petrol – fell 8% in March to 24% below the five-year average,” said Howie.