If you expect your income to grow, you’re using a car for business, or you have sufficient savings in the bank, a balloon payment may be the way to go when buying your next ride.

A balloon payment is a great way to lower your monthly vehicle ownership costs but it can be treacherous for people who don’t know how it works.

A balloon payment is a lump sum you agree to pay at the end of your financing term.

As such, instead of paying off the full loan amount over your loan period, a portion of it is set aside to be paid at the end.

This portion is calculated as a percentage of the vehicle price, and usually ranges between 20-30%.

There are several benefits to such a deal, according to Naked Insurance.

For one, you’ll enjoy lower monthly repayments during the course of ownership which means you can save more money, or get a better car.

If you like upgrading your wheels every few years, a balloon payment can work well if you plan to trade it in before the final payment is due.

However, balloon payments also have their fair share of pitfalls.

You’ll have a big payment due at the end of the contract, and if you can’t afford it you’ll either have to refinance the balloon, extend the loan term, or sell your car.

Another drawback is that you’ll end up paying more for the vehicle as interest is charged on a bigger amount throughout the contract duration.

Lower monthly repayments might also make it easier to justify spending more than you can actually afford.

As such, there are few instances in which a balloon payment makes financial sense.

“If you know you’ll have the funds, whether through savings, a bonus, or another source, when the balloon payment is due, this option can make financial sense,” said Naked Insurance.

Likewise, if you’re early in your career and confident that your earnings will increase, you might be more comfortable handling the lump sum later on.

Finally, if you’re using the car for business you can claim tax deductions on depreciation, interest, fuel, maintenance, and even the balloon payment.

This option can help with cash flow while maximising tax benefits.

“Before you decide, run the numbers, think about what you’ll do when the payment is due, and make sure it fits your long-term budget,” said Naked Insurance.

“Balloon payments can be a useful tool in car financing, but they require careful consideration.”

Balloon payments on the rise

Standard Bank VAF last year revealed that it saw a 41% increase in the amount of new-vehicle purchases that include a balloon payment in the past five years.

Even more surprising, a third of Standard Bank customers who purchased a car between July 2023 and 2024 opted to include the maximum balloon payment of 40%.

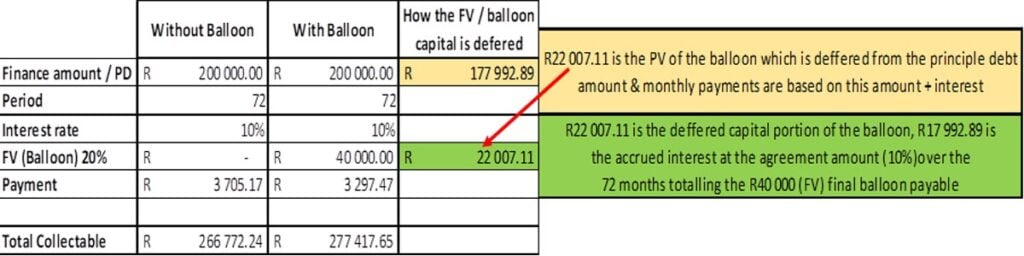

“A balloon payment works like a deferred debt that consumers can opt to move to the end of their contract,” said head of Standard Bank VAF, Glenn Stead.

“Monthly instalments are then calculated based on the principal debt minus the deferred debt portion.”

That said, Stead noted that many consumers do not fully comprehend how this type of deal will affect them down the line.

The consumer knows at the beginning of their contract how much they will need to pay after their last instalment.

When the time comes, they can pay off the balloon in cash or enter into a new agreement to re-spread the payment.

“Because re-spreading qualifies as a new agreement, consumers can spend an extra 12, 24, 36 months paying off the balloon amount,” said Stead.

You can therefore only take ownership and get your original registration documents once the full balloon amount is settled, which may be months or years later than initially planned.

Additionally, a balloon payment ends up costing you noticeably more in the long run.

“The total amount the consumer will pay at the end of their financing term will be higher with a balloon payment,” he said.

For instance, when a consumer buys a R200,000 vehicle at 10% interest rate and opts for a 20% balloon will pay R10,000 more after six years.

“This is because while the consumer pays interest on the principal debt, there are no payments made towards the balloon amount,” said Stead.

“Interest is charged from day one on the balloon amount, too.”

The following table, as provided by the bank, details the difference between a car finance contract with and without a balloon: