Finance Minister Enoch Godongwana has announced that the General Fuel Levy (GFL) will be hiked for the first time in three years.

This comes after significant pushback against a planned VAT hike that was supposed to mitigate any fuel tax increases.

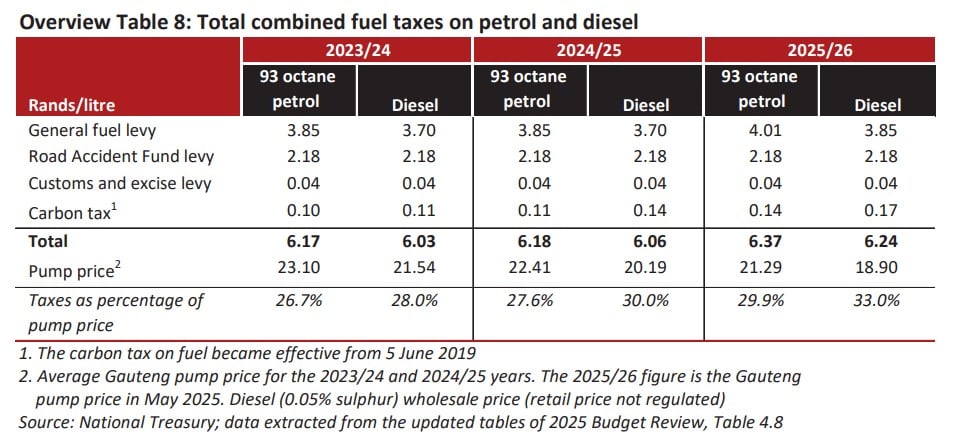

The GFL will now increase by 16c per litre for petrol and 15c per litre for diesel effective 4 June 2025.

“The general fuel levy has remained unchanged for the past three years to provide

consumers with relief from high fuel price inflation,” said Finance Minister Enoch Godongwana.

“To replace a portion of the lost revenue from the withdrawal of the VAT rate increases, government proposes an inflationary increase in the general fuel levy for petrol and diesel.”

The expansion of the GFL is on top of a 3c per litre Carbon Levy increase that already took effect in April.

The Carbon Levy is an add-on to the GFL, meaning the latter is effectively rising by 19c and 18c per litre for petrol and diesel, respectively, in the coming financial year.

Therefore, from 4 June onwards, the GFL will be pegged at R4.01 per litre for petrol and R3.85 per litre for diesel.

On the bright side, Godongwana announced no changes to the Road Accident Fund (RAF) Levy, the second-biggest tax on local fuels.

The table below, as provided by Treasury, details the total combined taxes on petrol and diesel for the coming financial year:

Third time unlucky

The first two instalments of the 2025/26 budget proposed no increases to fuel taxes in South Africa.

Instead, government pursued a controversial increase to VAT.

The original idea was that increasing the GFL and RAF Levy to make up for lost revenue would put too much pressure on a small portion of the population.

Likewise, Treasury ruled out raising corporate and personal income taxes, as well as refused to take on more debt.

It deemed that an increase to VAT was the only way to plug its monetary holes, a decision that was met with fierce backlash from the public, civil society organisations, and political parties.

Sanity prevailed, and Minister Godongwana announced in late April 2025 that the VAT hike would no longer take effect, mere days before it was supposed to come into play.

It was thus only a matter of time until fuel taxes were targeted, as they are one of the easiest avenues for revenue generation.

Motorists rarely think about taxes when refueling their vehicles as all they see is the price at the pump, but not how much of that price goes to taxes and levies.

Moreover, fuel consumption has remained relatively stable in recent years as the country’s total car parc continues to float around 13 million vehicles.

As such, Treasury can calculate almost exactly how much it must hike the GFL to reach its budgetary goals unlike with other forms of taxes.

The Fuels Industry Association of South Africa warned that any increases to fuel taxes will immediately raise the prices at the pumps, resulting in higher costs for drivers.

“As fuel prices rise, transportation costs will likely increase, leading to higher prices for goods and services, adding to inflationary pressures,” it said.

“Many consumers, already feeling financial strain, may find it increasingly difficult to cover daily commuting and travel expenses.”