New and used mid-size SUVs experience huge price jumps in South Africa – The numbers

TransUnion’s latest vehicle price index (VPI) has found that new car prices in South Africa rose at an average rate of 6.7% during the second quarter of 2023, a big jump over the 3.9% experienced in the same period in 2022.

Similarly, prices of used vehicles climbed at a staggering average of 9.8% in Q2 of this year, up from 8.3% recorded in Q2 of last year.

The VPI measures the relationship between the increase in vehicle pricing for new and used models from a basket of passenger cars in South Africa that includes 15 top-volume manufacturers, essentially providing a barometer for car price inflation.

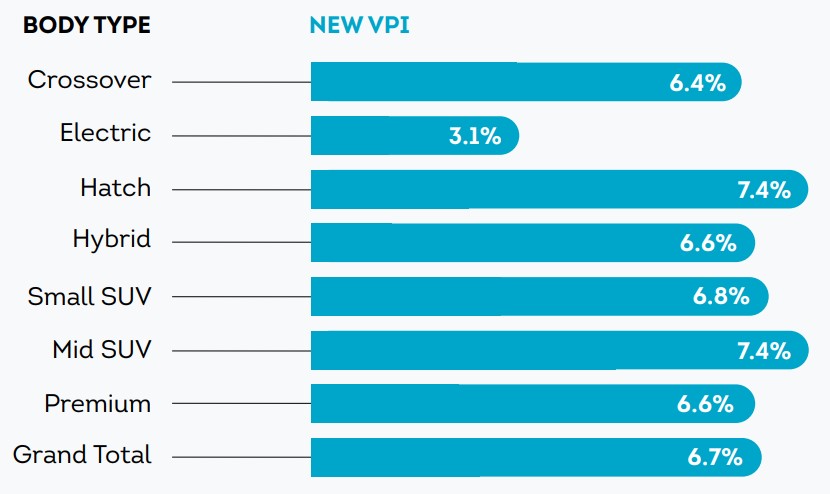

VPI per body type

In the new market, hatchbacks and mid-size SUVs had the highest VPIs for Q2 2023 both sitting at 7.4%, indicating that these body styles are in high demand for local new-car buyers.

On the other end of the spectrum, electric vehicles (EV) saw the lowest VPI at 3.1%, “although this figure may not be a reliable reflection as waiting periods [for EVs] can exceed six months,” said Lee Naik, CEO at TransUnion Africa

The remaining categories comprising crossovers, small SUVs, hybrids, and premium autos then experienced average price increases of between 6.4-6.8%.

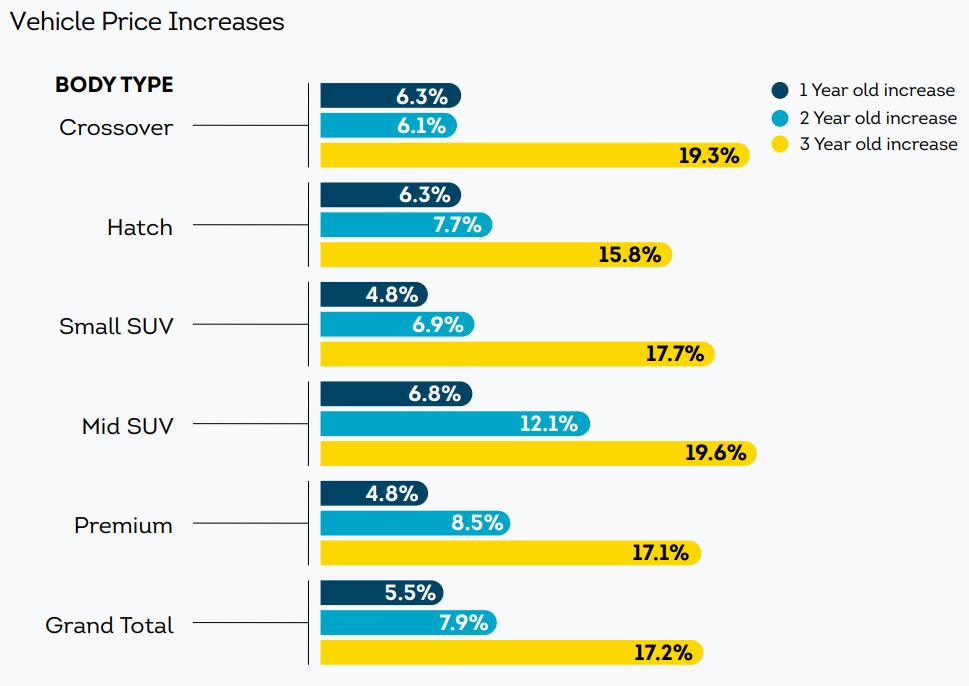

In the used market, the highest VPI once again was for mid-size SUVs at 6.8% for one-year-old models, 12.1% for two-year-old models, and a massive 19.6% for three-year-old models.

In layman’s terms, this means that prices of pre-owned mid-size SUVs registered in 2020 increased by an average of 19.6% during Q2 2023, those registered in 2021 went up by 12.1%, and those registered in 2022 rose by 6.8%.

This is noticeably higher than the industry average of 5.5% for one-year-old, 7.9% for two-year-old, and 17.2% for three-year-old used cars.

The higher average VPI for pre-owned than for new vehicles is a result of a short supply of quality examples in the used market, which is a consequence of low new-car sales in previous years that were hampered by the Covid-19 pandemic, component shortages, and supply chain issues.

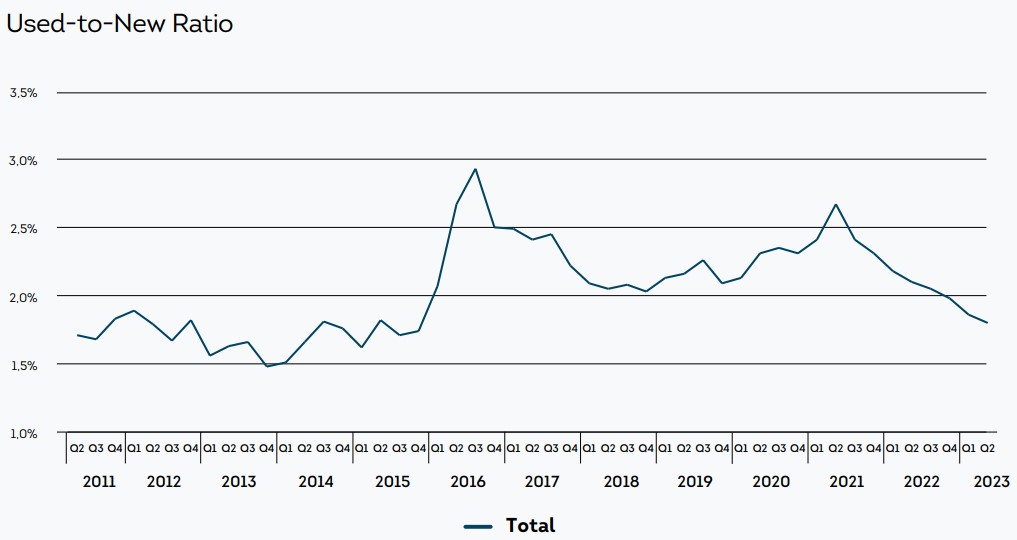

This is further emphasised by a decrease of over 6% in vehicles financed between the two periods, as well as the fact that the used-to-new finance ratio – i.e. the number of used cars financed for every new car – was recorded at 1.80:1 in Q2 2023, much lower than the 2.10:1 from Q2 2022.

“High-quality used vehicles are in short supply because of low new vehicle sales in the previous couple of years. Together with the rising cost of vehicle ownership and consumers having no positive equity in their current vehicles, it is increasingly burdensome for consumers to upgrade their vehicles,” said Naik.

“Faced with limited options, they’re turning to older used vehicles that are more affordable, vehicle rental options, or staying out of the market completely. This trend is likely to continue in the near term.”

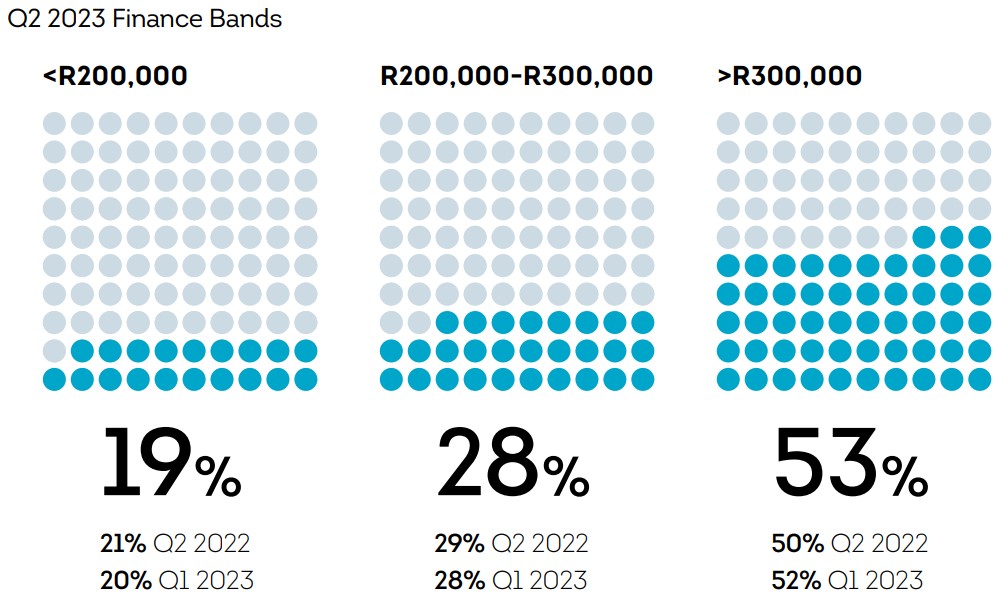

Most popular finance bands

With ever-rising car prices on the new and used markets, the most popular finance band by far in Q2 2023 was the R300,000-plus category, which accounted for 53% of all vehicle finance contracts during the period, up from 50% in 2022.

The R200,000-to-R300,000 band account for 28% of transactions, down 1% year on year, and the under-R200,000 band was responsible for 19%, down 2%, which is the lowest it has been since 2011.

With affordability being a serious issue in the current automotive landscape, consumers are increasingly opting for alternative financing such as vehicle rentals or uncollateralised loans to cover shortfalls.

This shift in buying preferences and price hikes is reflected in the average loan size increasing from R370,000 to R390,000 year on year.

“The vehicle market remains in a state of flux due to frequent power cuts, ongoing increases in the repo rate, and various other factors influencing the total cost of vehicle ownership. These factors continue to exert downside pressure on consumer and business confidence, negatively affecting vehicle demand,” said Naik.

“With a shortage of quality used stock, consumers are increasingly gravitating toward older used vehicles or repairing current vehicles. This creates opportunities for businesses focussed on refurbishment and repairs and alternative mobility solutions providers.”