Work from home has been all but abolished in South Africa, with petrol stations reaping the rewards of the return of the office commute.

Discovery Bank’s latest SpendTrend25 report revealed that as more people return to the workplace, fuel spending has surged.

“After a 4% decline in 2023, average fuel spend per active card grew by 5% in 2024, marking a sharp nine percentage point increase,” said the bank.

The institution found that its average client now does approximately 118 trips a month covering a distance of around 1,100km, equating to an average of 35 hours spent inside their vehicles over this period.

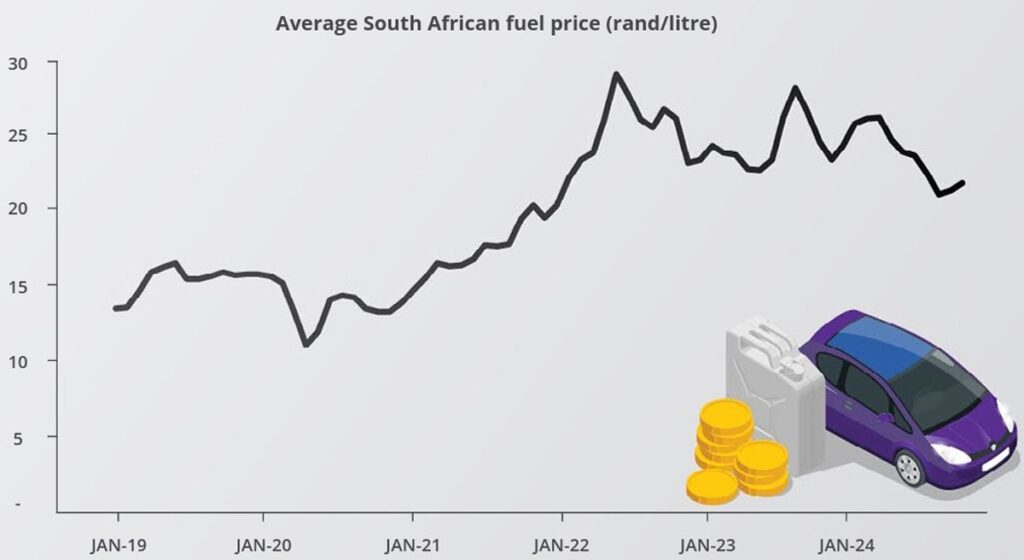

Additionally, with fuel prices being on average lower in 2024 than in the years prior, consumers are now settling for convenience over a margin of economy in deciding when to fill up.

“As fuel prices have steadied over the past two years, there is less of a rush to refuel on Tuesdays ahead of the Wednesday price hike,” said Discovery.

It further determined that Discovery Bank clients prefer to refuel on Fridays so that they are set for the weekend and the new week ahead.

Their favourite fuel stations comprise bp, Engen, and Shell.

When it comes to who spends the most on fuel, consumers over the age of 50 were the clear leaders, followed by those aged 41 to 50, then 31 to 40, then under 30.

Discovery Bank noted that fuel remains one of the top expenses for consumer regardless of age, alongside groceries, retail, travel, and eating out.

Collectively, these expenses amount to over 70% of consumers’ total purchases.

Looking ahead

Looking ahead, Discovery expects that the return-to-office trend will continue, which should further boost revenue of petrol stations in the country’s urban hubs.

“Many companies are encouraging workers to return to the office by enforcing hybrid and in-office work models,” said the bank.

“As a result, consumers who had previously semi-grated are now returning to urban centres to manage costs.”

This is likely to persist throughout 2025 as more companies continue to encourage more in-office days.

This will no doubt be music to many station owners’ ears as the demand for fuel continues to shrink in South Africa.

Another expectation, which epitomises recent behaviours in the automotive industry, is that brand loyalty will decline as consumers seek more value for their hard-earned money.

“With the rise in the cost of living, consumer brand loyalty will continue to decline as consumers seek the best product for the best price,” said Discovery Bank.

“We anticipate that consumers will seek brands that deliver quality at competitive prices rather than paying premiums for established names alone.”

This trend has been especially prevalent in the auto sector in modern times, with buyers increasingly going for cars from Chinese and Indian brands in favour of their well-established European and Japanese rivals.

Likewise, they are opting for smaller, more affordable models like hatchbacks and crossovers instead of sizeable sedans and SUVs; or vehicles that can fulfill multiple purposes.

Discovery Bank also notes that the 12.7% increase in electricity tariffs effective 1 July will result in a higher cost of living for South African consumers.

“As a result, consumers, will continue to seek value in their spending and likely further adopt subscription services that offer discounts and savings in order to stretch disposable incomes further,” said the company.

While Discovery didn’t particularly single out car subscriptions, this is something that could receive a boost.

Credit agency TransUnion recently highlighted that alternative ownership models like leasing, subscriptions, and rent-to-buy agreements gained traction in 2024.

These services – which bundle rental, insurance, warranties, and tracking fees – allow one to “own” and maintain a vehicle for a few years through a single monthly payment.

They are attractive for individuals with variable income streams or evolving credit profiles, as well as for consumers who are unable to access traditional credit.

They enable these higher-risk borrowers to build up a repayment profile over time and, in certain cases, ultimately acquire ownership of a vehicle.